The Degree-Free Insurance Career Report, 2025

A data-driven look at the rise of skills-first careers, stackable credentials, and a generation skipping the debt.

Research conducted by Aceable in partnership with Kickstand

Stay updated with industry news, learn about life as an insurance agent, and get exclusive offers on our course!

Quick Answer

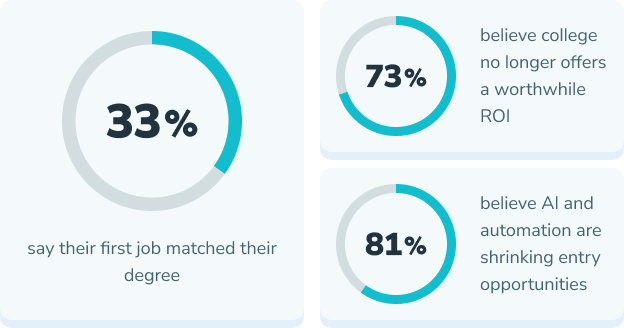

- 73% of Gen Z believe the cost no longer matches the career payoff, and only 33% of grads say their first job aligned with their degree

- 46% have already completed licensure, certification, or vocational programs, and 63% expect these non-degree paths to drive their career growth over the next 5 years

- 86% define success as control over their time (not job titles), 78% maintain side hustles, and 67% would choose contract work over full-time employment for more autonomy

How Generation Z Defines Success

Freedom Over Prestige

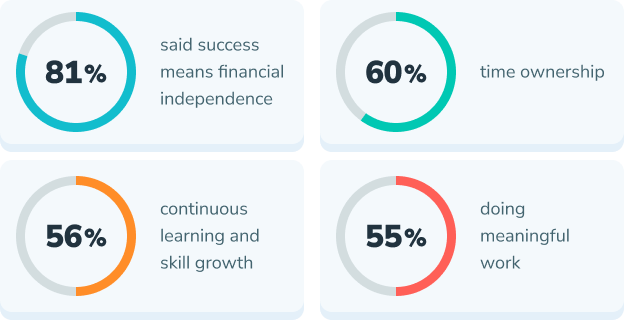

When asked what success means, Gen Z's answers look nothing like those of previous generations:

Only 27% associate success with career advancement.

Passion Over Paycheck

65% say personal interests and passions drive their career decisions, outranking both earnings potential (49%) and job stability (43%).

This doesn't mean Gen Z isn't ambitious or financially motivated. It means they refuse to separate what they do from who they are. Work isn't just a paycheck—it's an extension of identity, purpose, and values.

College Is One Option. Not the Only One.

Nearly two-thirds (63%) of Gen Z say a four-year degree is helpful—but recognize it's not the only route to success.

And they have legitimate reasons for exploring alternatives:

- Only 1 in 3 college grads says their first job directly aligned with their degree.

- 73% feel the cost of college doesn't always match the career outcomes.

- 81% observe that AI and automation are reshaping entry-level opportunities, even for degree holders.

Even among college grads, the path wasn't always clear. Just 30% knew their major and career direction from the start. Nearly a third figured it out along the way.

Here's what this tells us: college can absolutely work, but it's not a one-size-fits-all solution. And Gen Z is smart enough to recognize when other options might serve them better.

Why Traditional Degrees Are Losing Their Grip

College Isn't a Must-Have Anymore

72% of Gen Z personally know someone who has built a sustainable career without a college degree. These aren't hypothetical success stories; they're neighbors, relatives, mentors, and role models proving that alternative paths work.

- Parents who succeeded without degrees, or despite having them

- The cost-to-outcome equation breaks down

- AI is reshaping the job market faster than curricula can adapt

The ROI Problem

Even those who attended college often felt uncertain. Just 30% of grads were clear about their primary and career path from the start, 29% had to figure it out along the way, often while accumulating significant debt.

The system promised clarity and opportunity. What it delivered was an expensive trial-and-error.

The Rise of Career Programs & Licensing

Gen Z isn't abandoning education; they're choosing pathsPre License What Skills Do You Need To Become An Insurance Agent Resources with clearer outcomes and faster returns.

The Numbers Tell the Story

- 46% have already completed a licensure, certification, or vocational program

- 31% are actively interested

- 12% are currently enrolled

- 1 in 3 plan to continue stacking credentials every 3–4 years

What They're Looking For

When choosing career programs, Gen Z prioritizes:

- Clearer job placement outcomes (44%)

- Interest in lifelong learning (41%)

- Faster time to income (39%)

These aren't students looking for shortcuts. They're pragmatic learners who want education that delivers on its promises, quickly, affordably, and with measurable results.

A New Way to Learn

The four-year lecture hall no longer represents the ideal learning environment for most Gen Z adults.

Instead, they want education that adapts to their lives:

- 83% prefer hybrid models with stackable short-term credentials

- 79% believe non-degree programs lead to income faster—for a fraction of the cost

- 68% say future-proof careers require pairing certification with AI skills

Stackable Credentials Are the New Degree

Rather than committing four years and tens of thousands of dollars to a single path, Gen Z is building careers through credential stacking:

Get licensed → Gain experience → Add specialized certifications → Stay current with ongoing education

This model offers flexibility, affordability, and the ability to pivot as industries and interests evolve. And with one in three planning to refresh credentials every 3–4 years, continuous learning is becoming the norm, not the exception.

Getting your insurance licensePre License Why Insurance Is The Best Career To Start Without A College Degree Resources is just the first step; from there, you can pursue specialized designations in areas like life insurance, health insurance, or commercial coverage.

What Employers Need to Know

If you're still requiring four-year degrees for roles that don't truly need them, you're missing out on a massive talent pool.

Gen Z Isn't Chasing Titles; They're Optimizing for Life

The data reveals a generation with different priorities:

- 67% would choose contract work over full-time employment if it gave them more control

- Only 16% say job titles matter in their ideal role

- 86% want to measure success by freedom over their time—not promotions

What They Actually Want

When evaluating job opportunities, Gen Z prioritizes:

- Flexible hours (63%)

- Remote or hybrid options (53%)

- Purposeful work (52%)

Meanwhile, traditional status markers like prestigious titles rank near the bottom.

The Insurance Industry Is Adapting

Financial services and insurance ranked as the #4 career interest for Gen Z (10%), with men 80% more likely than women to express interest in the field.

And 24% of career program graduates say their employer is helping them pursue credentials—with employer support highest in healthcare (27%), technology (23%), and financial services and insurance (15%).

Forward-thinking insurance companies are already embracing skills-first hiring and supporting their teams in getting licensed and advancing their credentials.

Skills-First Hiring Wins

Aceable's take: Skills-first employers will win the talent war. Our credentialed learners don't just have the license—they've already demonstrated initiative, self-direction, and the ability to complete rigorous training independently.

These are precisely the qualities that predict success in autonomous, remote, and entrepreneurial roles.

What This Means for Career Ownership

Gen Z isn't just looking for jobs; they're building careers they can own.

Side Hustles Are Becoming Main Hustles

78% currently maintain a side hustle, income stream, or passion project outside their main work or studies.

Of those:

- 42% plan to turn their side project into a formal business within 5 years

- 73% say AI tools make it easier to launch a business or independent practice

- 71% believe entrepreneurship is just as viable as a college degree for long-term stability

The Insurance Industry Offers Unique Ownership Opportunities

Few industries offer the same combination of licensing, autonomy, and income potential as insurance.

Licensed insurance professionals can:

- Work as independent agents with full control over their businessPre License How Do I Become An Insurance Agency Owner Resources

- Join established agencies with flexible commission arrangements

- Build recurring income through policy renewals and client retention

- Scale their practice over time without massive upfront investment

- Work remotely with clients across their licensed states

And with AI tools now simplifying administrative tasks, marketing, and client communication, launching an independent insurance practice has never been more accessible.

The Path Forward: Removing Barriers

While career programs offer clear advantages, barriers still exist:

- 57% cite upfront cost as the main barrier

- 50% point to time commitment

- 34% say unclear career outcomes hold them back

But the ROI Is Proven

Among those who complete career programs:

81% say the return on investment met or exceeded expectations

And the solution is already clear: 66% say flexible or online scheduling would make them more likely to pursue credentials.

This is exactly what Aceable delivers, mobile-first education that fits your schedule, with transparent outcomes and support every step of the way.

Our insurance licensing courses are designed to:

- Fit your schedule with mobile-first learning you can do anywhere

- Get you licensed faster with state-specific prep that actually works

- Show clear outcomes with transparent pass rates and career guidance

- Cost less than traditional classroom courses

Explore insurance licensing optionsPre License Insurance Licensing Questions Resources in your state to see exactly what's required, how long it takes, and what career paths open up once you're licensed.

Build a Career That Lasts

Aceable’s modern insurance education prepares you for stability and long-term impact