Why the Insurance Industry is Rethinking How it Trains New Talent

Stay updated with industry news, learn about life as an insurance agent, and get exclusive offers on our course!

Quick Answer

- The insurance talent gap isn't about finding candidates; it's about outdated licensing processes that push motivated learners out before they ever get started.

- Mobile-first, flexible pre-licensing courses are becoming the industry standard as more states embrace online education formats.

- Gen Z and career changers prefer stackable credentials, licenses, and certifications that offer clear ROI without requiring a four-year degree.

Every year, the insurance industry talks about how to bring in fresh talent, and for good reason. It is a career path full of opportunity, especially for the next generation. But in 2026, something exciting is happening: the conversation is finally evolving.

We are not just asking how to attract more people into the industry. We are rethinking how we train them once they are here. And that shift is unlocking real potential.

Because the real problem? It is not who we are hiring. It is how we are training them.

And the solution? It starts with how and where we license.

It starts with educators like Aceable Insurance.

Outdated Licensing Models Are Pushing People Out Before They Ever Get In

Insurance is one of the most stable, flexible, and financially promising careers out there. According to the U.S. Bureau of Labor StatisticsSales Insurance Sales Agents.htm Ooh, insurance sales agent positions are projected to grow steadily, with median annual wages exceeding $60,000. But the entry process? Still stuck in the early 2000s.

Confusing PDFs. Legacy portals. Frustrating requirements that vary by state and feel impossible to decode.

It is no wonder that 47% of Gen Z candidates who express interest in an insurance careerPre License Career Opportunities Insurance Producers Illinois Resources abandon the process due to unclear or outdated licensing requirements.

That is not disinterest. That is friction.

"2026 is the year we admit traditional licensing is broken."

Tim Johnson, Insurance Analyst at Aceable Insurance

As more states open the door to online pre-licensing and CE formats, mobile first, tech enabled courses will become the baseline, not the exception. And with good reason.

Aceable Insurance's mobile first courses are designed for today's learners:

- Fully online, mobile ready

- Modular, bite sized learning that fits real life

- Approved in the states that matter

- Built to actually help you pass (and stay compliant)

We are not just modernizing the experience. We are transforming it.

Flexibility, Clarity, and Career Ownership

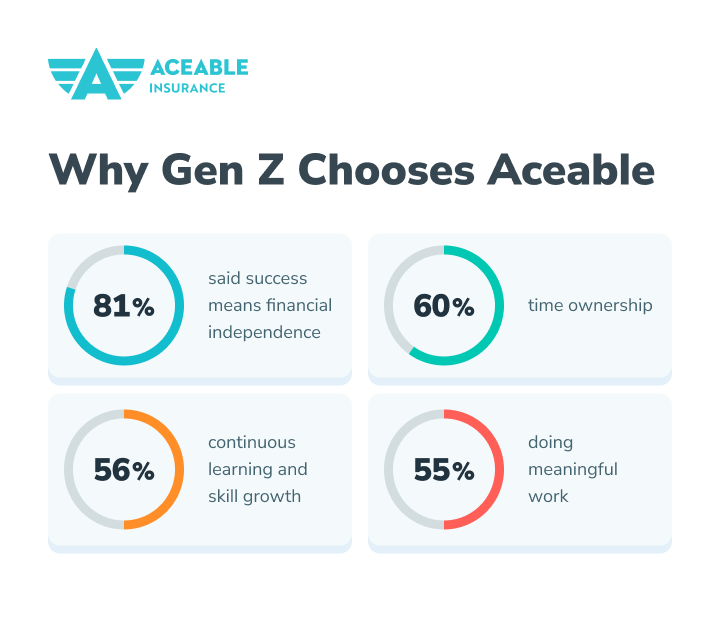

This new generation of insurance professionals is not looking for fluff. They are looking for fast, flexible, career-aligned learning they can trust. According to Aceable's Ownership Economy Study.

That is why Aceable's pre-licensing and CE courses are built around flexibility, affordability, and forward momentum so learners can start earningPre License How To Become An Insurance Agent With No Experience Resources and growing sooner.

Whether you are starting outPre License Why Become A Life Health Insurance Agent Resources or renewing, our courses move with you, not against you.

Ready to take your insurance career to the next level?

If you’re eager to learn how to not only get licensed but also thrive in your insurance career, check out our Tips for Becoming a Successful Insurance Agent.

Stack Credentials. Build Confidence. Stay Ahead.

For Pre-Licensing Students

Aceable gives you a guided, mobile first path from zero to licensed. Our state approved, recruiter recommended courses strip out the fluff and give you exactly what you need to pass with confidence, on your terms.

For Licensed Agents

Our continuing education bundles keep you compliant without killing your calendar. Knock out your CE with courses that are clear, mobile friendly, and actually useful.

For Everyone

Credential stacking is the future. Whether it is adding a new line of authority or building toward specializations, Aceable makes it easy to level upPre License Tips Becoming A Successful Insurance Agent Resources every few years without starting over.

What Makes Aceable the Right Choice for 2026 and Beyond

- Mobile first, modern formats: Learn anywhere, anytime

- State approved and recruiter trusted

- Stackable, career advancing credentials

- Real ROI: not just a certificate, but a launchpad

As Tim Johnson puts it:

"Agents who treat continuous learning as part of their daily workflow will be the ones who thrive. And they will turn to platforms like Aceable, built for how modern professionals actually learn and live."

The Bottom Line

If we want to close the insurance talent gap in 2026, we need more than job boards and recruiting bonuses.

We need licensing and CE solutions that actually work for the people entering this field and for those building a long-term future in it.

Aceable is that solution.

Clear. Flexible. Actually enjoyable.

Because the question is not "Why will they not finish?"

It is: Why are we still making it this hard to begin?

Ready to Get Licensed or Stay Compliant the Easy Way?

Aceable Insurance offers state approved pre-licensing and continuing education courses designed for how you actually live and learn. Mobile first. Recruiter recommended. Built to help you pass and build a career you are proud ofPre License What Are The Best Paying Jobs In Insurance Resources.

Ready to take the first step?

Your future in the insurance industry starts now.