What Score Do I Need to Pass the Missouri Insurance Exam?

Want 30 Free Insurance Practice Exam Questions?

Sign up and get 30 free practice questions delivered to your inbox, complete with answers and an exclusive discount on Missouri insurance licensing courses.

Quick Answer:

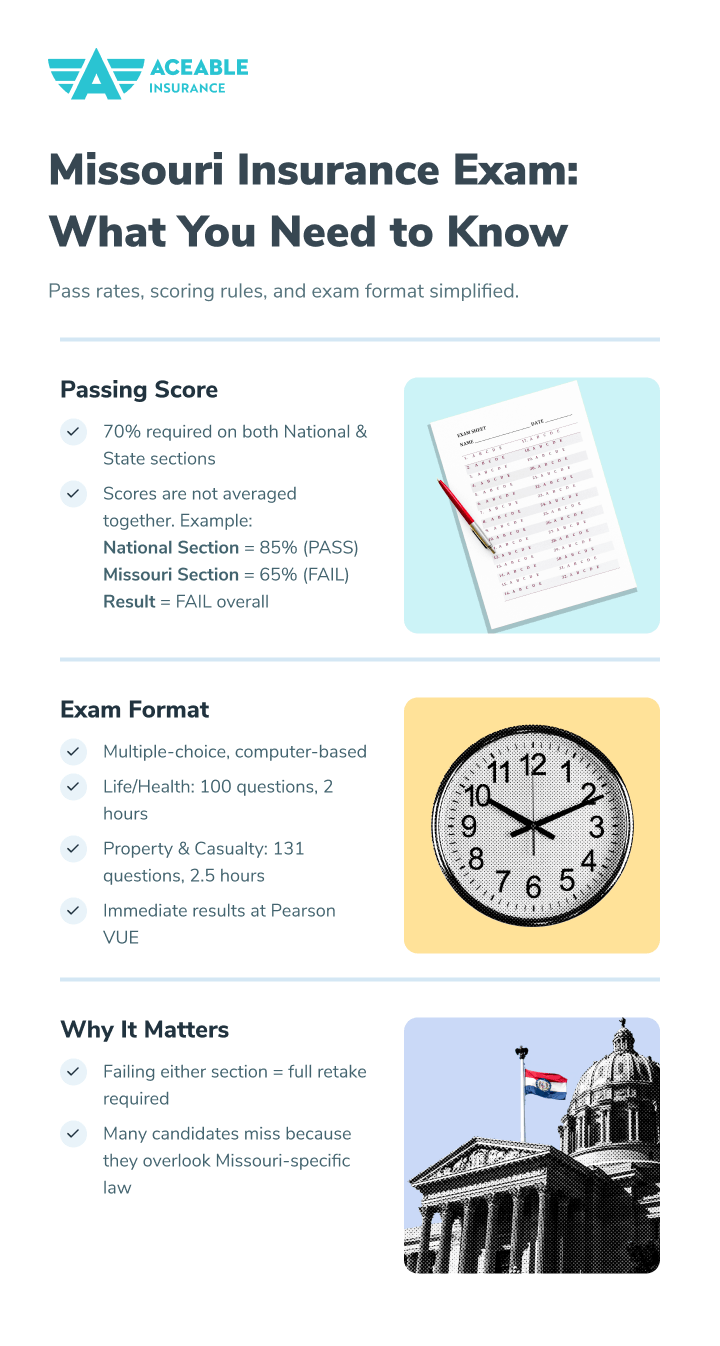

- Missouri requires 70% on both national and state sections separately (not averaged together)

- All questions are multiple-choice administered by Pearson VUE

- Exam length varies by license type: Life (2 hours, 100 questions) to P&C (2.5 hours, 131 questions)

Missouri's Unique Dual-Section Scoring System

Missouri insurance examsResources Pre License What To Expect On The Missouri Insurance Exam Craft V3.ecom Stage.aceable.com consist of two distinct sections, each requiring separate mastery for overall success.

Section Breakdown:

- National Section: General insurance principles, concepts, and federal regulations

- State Section: Missouri-specific laws, regulations, and market practices

- Scoring Requirement: 70% minimum on each section separately

- Critical Point: Sections are not averaged together - you must achieve 70% on both

Why This Matters: Many candidates mistakenly believe they can compensate for weakness in one section with strength in another. This is incorrect - both sections must individually meet the 70% threshold.

Example Scenario:

- National Section: 85% (PASS)

- Missouri State Section: 65% (FAIL)

- Overall Result: FAIL - despite high national score

This scoring system emphasizes the importance of thoroughly preparing for both national concepts and Missouri-specific requirements.

Exam Format by License Type

Missouri offers several license types, each with specific format requirements administered by Pearson VUEEn Mo Insurance.html Us.

Life Insurance Producer:

- Total Questions: 100

- Time Limit: 2 hours

- National Section: Approximately 60-70 questions

- Missouri Section: Approximately 30-40 questions

Accident & Health Insurance Producer:

- Total Questions: 100

- Time Limit: 2 hours

- National Section: Approximately 60-70 questions

- Missouri Section: Approximately 30-40 questions

Life, Accident & Health Combined:

- Total Questions: 100

- Time Limit: 3 hours

- National Section: Approximately 70 questions

- Missouri Section: Approximately 30 questions

Property & Casualty Producer:

- Total Questions: 131 (115 scored, 16 pretest)

- Time Limit: 2.5 hours

- National Section: Approximately 85-90 questions

- Missouri Section: Approximately 25-30 questions

Personal Lines Producer:

- Total Questions: 131 (115 scored, 16 pretest)

- Time Limit: 2.5 hours

- National Section: Approximately 85-90 questions

- Missouri Section: Approximately 25-30 questions

Understanding how to prepare effectivelyResources Pre License How To Study Insurance Licensing Exam Insurance.aceable.com for both sections is crucial for Missouri exam success.

Question Types and Categories

Missouri insurance exams feature three primary question categories that require different preparation approaches.

Terminology Questions (Approximately 33%): Test your knowledge of insurance definitions, concepts, and industry vocabulary. Example: "What is the definition of 'moral hazard' in insurance underwriting?"

Numerical/Detail Questions (Approximately 33%): Focus on specific amounts, time periods, percentages, and regulatory requirements. Example: "In Missouri, what is the maximum time period for filing a claim under a standard homeowners policy?"

Application/Scenario Questions (Approximately 33%): Present situations requiring you to apply insurance knowledge to solve problems. Example: "A Missouri resident has a homeowners policy with 80% coinsurance and a $200,000 dwelling limit. The actual value is $300,000. After a $50,000 loss, how much will the insurance company pay?"

Pre-Test Questions: Some exams include unmarked pre-test questions that don't count toward your score but help develop future exams. These questions are indistinguishable from scored questions.

Missouri State Law Emphasis

The Missouri state section covers specific laws, regulations, and practices unique to the Show-Me State.

Key Missouri Topics:

- Missouri Department of Commerce and InsuranceInsurance.mo.gov authority and procedures

- State-specific licensing requirements and renewal procedures

- Missouri insurance code provisions and penalties

- Workers' compensation regulations (for applicable licenses)

- State insurance guaranty association procedures

- Consumer protection laws and regulations

Missouri-Specific Study Focus:

- State insurance statutes and administrative codes

- Penalty amounts and timelines specific to Missouri

- Local market conditions and regulatory environment

- Professional licensing and continuing education requirements

Common Missouri State Questions:

- Licensing renewal deadlines and requirements

- State-specific policy provisions and endorsements

- Missouri Department authority and enforcement procedures

- Consumer protection and claims handling regulations

Many successful candidatesResources Pre License How To Become An Insurance Agent With No Experience Insurance.aceable.com with no prior experience focus extra preparation time on Missouri state law to ensure section success.

Ready to take your insurance career to the next level?

If you’re eager to learn how to not only get licensed but also thrive in your insurance career, check out our Tips for Becoming a Successful Insurance Agent.

Exam Administration and Technology

Computer-Based Testing:

- All exams administered on computers at Pearson VUE centers

- Multiple-choice format with point-and-click selection

- Immediate preliminary results upon completion

- Official results transmitted to Missouri Department within 48 hours

Testing Center Procedures:

- Arrive 30 minutes early for check-in process

- Bring required identification (government-issued photo ID)

- Personal items stored in provided lockers

- Calculators provided when needed (no personal calculators allowed)

Retake Policies and Procedures

Immediate Retake Availability:

- Can register for retake 1-2 days after previous attempt

- Pearson VUE system updates 24-48 hours after completion

- Recommend waiting at least 24 hours before scheduling retake

Retake Strategy:

- Review detailed score report to identify weak areas

- Focus additional study on failed sections

- Consider comprehensive exam preparation if self-studying initially

- Many candidates benefit from structured courses before retaking

Retake Fees:

- Full exam fee required for each attempt

- No discounts for multiple attempts

- Consider cost-benefit of quality preparation versus multiple attempts

Preparation Strategies for Dual-Section Success

Balanced Study Approach:

- Allocate study time proportionally to question distribution

- Spend 60-70% of time on national concepts

- Dedicate 30-40% of time to Missouri-specific content

- Practice with questions from both sections regularly

Missouri State Law Mastery:

- Create summary sheets of Missouri-specific requirements

- Use flashcards for state law terminology and numbers

- Practice applying Missouri laws to different scenarios

- Quiz yourself regularly on state-specific content

National Concepts Foundation:

- Master fundamental insurance principles first

- Understand policy structures, coverages, and exclusions

- Practice calculations and numerical applications

- Learn industry terminology and standard practices

Understanding your earning potentialResources Pre License What Could Your Insurance License Be Worth Insurance.aceable.com after licensing can help maintain motivation during challenging preparation periods.

Practice Testing and Score Improvement

Effective Practice Testing:

- Take practice exams under timed conditions

- Use realistic question formats and difficulty levels

- Track scores for both national and state sections separately

- Identify patterns in missed questions for targeted study

Score Improvement Strategies:

- Focus extra study time on consistently missed topic areas

- Review explanations for all practice test questions (right and wrong)

- Time yourself to ensure completion within exam limits

- Practice until both sections consistently score above 75%

Common Format Mistakes to Avoid

Scoring Misconceptions:

- Assuming sections average together (they don't)

- Focusing only on stronger section while ignoring weaker area

- Not understanding separate 70% requirement for each section

- Expecting partial credit (all questions are multiple-choice)

Time Management Errors:

- Spending too much time on difficult questions early in exam

- Not pacing properly between national and state sections

- Failing to review answers if time permits

- Rushing through state section to focus on longer national section

Preparation Mistakes:

- Insufficient focus on Missouri state law and regulations

- Over-relying on national study materials without state-specific content

- Not practicing with realistic question formats and timing

- Inadequate review of detailed score reports from practice tests

Exam Day Success Strategies

Pre-Exam Preparation:

- Arrive at testing center 30 minutes early

- Bring required government-issued photo identification

- Get adequate sleep (7-8 hours) the night before

- Eat a nutritious breakfast for sustained energy

During the Exam:

- Read each question completely before selecting answer

- Use process of elimination for difficult questions

- Manage time carefully - don't spend too long on any single question

- Review answers if time permits, focusing on uncertain responses

Section Strategy:

- Pay attention to which section you're in (national vs. state)

- Remember that both sections must individually reach 70%

- Don't let performance in one section affect confidence in the other

- Stay focused throughout the entire exam period

Understanding what daily lifeResources Pre License Tips Becoming A Successful Insurance Agent Insurance.aceable.com looks like as an agent can help motivate you through exam preparation challenges.

Understanding Your Score Report

Immediate Results:

- Preliminary pass/fail status shown on screen

- Detailed score report provided before leaving testing center

- Shows performance in each major topic area

- Indicates which sections were passed or failed

Score Report Analysis:

- Review performance by topic area to identify strengths and weaknesses

- Use detailed feedback for targeted study if retake needed

- Keep score reports for license application requirements

- Share results with education providers for additional support

Official Score Transmission:

- Pearson VUE transmits results to Missouri Department within 48 hours

- Passing scores automatically verified for license application

- No additional steps needed if both sections passed

- Failing scores require retake before license application

Missouri Market Preparation

Understanding Missouri's insurance market helps contextualize exam content and prepare for career success.

Missouri Insurance Landscape:

- Major metropolitan markets: Kansas City, St. Louis

- Diverse rural and agricultural insurance needs

- Growing technology and healthcare sectors

- Established regulatory environment supporting professional development

Maximize Your Missouri Exam Success

Success on Missouri insurance exams requires more than just understanding the format - it demands systematic preparation that addresses both sections effectively.

Why Choose Aceable Insurance for Missouri Exam Prep:

✓ Realistic Practice Exams - Mirror Pearson VUE format and difficulty level

✓ Missouri-Specific Content - Detailed state law coverage and applications

✓ Score Tracking Tools - Monitor progress in both sections separately

✓ Expert Support - Get help understanding complex concepts and calculations

✓ Proven Pass Rates - Our exam prep students consistently achieve first-time success

Ready to get started?

Your future in the Missouri insurance industry starts now.