How Much Does the Massachusetts Insurance Exam Cost?

Want 30 Free Insurance Practice Exam Questions?

Sign up and get 30 free practice questions delivered to your inbox, complete with answers and an exclusive discount on Massachusetts insurance licensing courses.

Quick Answers:

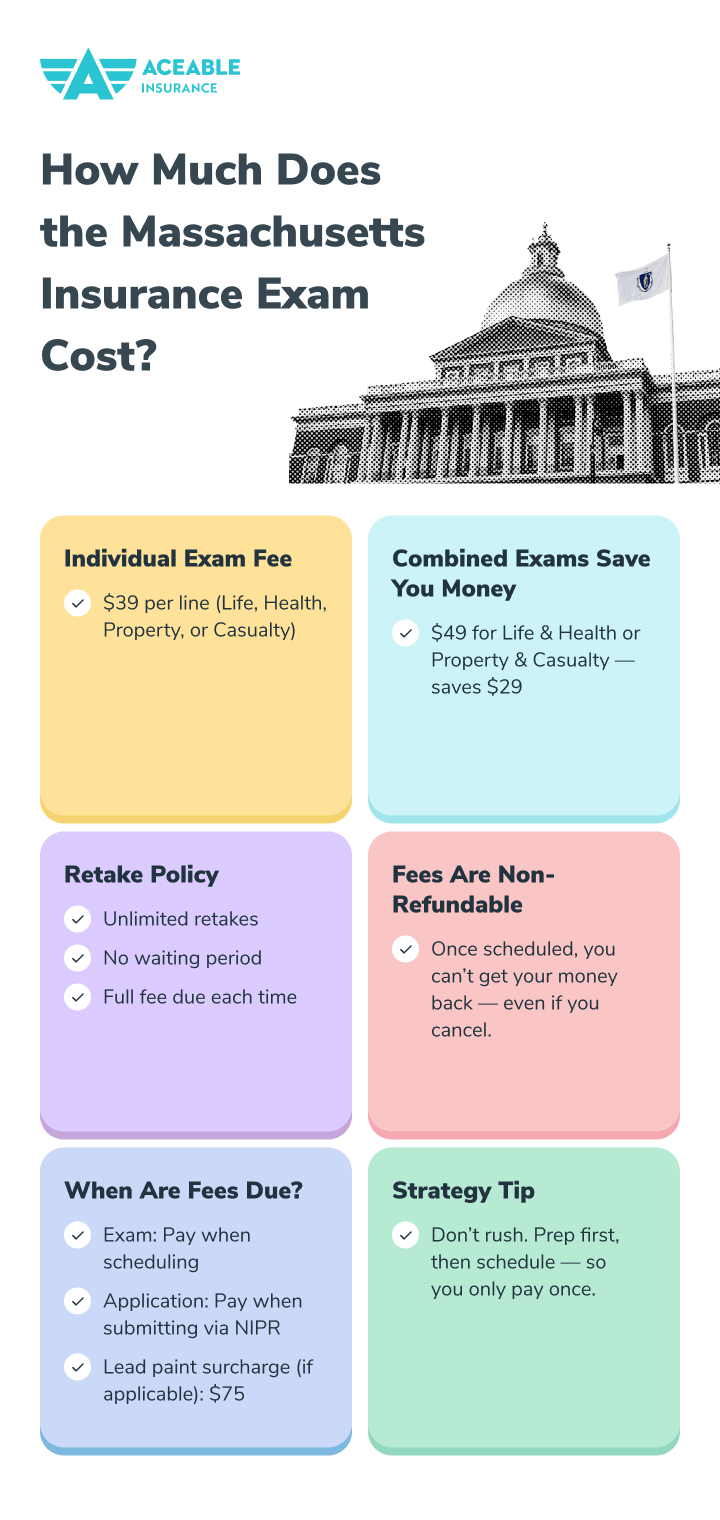

- Individual exam: $39 per line of authority (Property, Casualty, Life, or Health)

- Combined exams: $49 for two related lines taken together

- Unlimited retakes allowed with no waiting period, but full fee required each attempt

Understanding Massachusetts insurance exam costs helps you budget effectively for your licensing journey. While exam fees are relatively modest compared to other states, knowing all costs upfront prevents surprises and helps you plan your investment in your new insurance career.

Current Massachusetts Exam Fee Structure

Massachusetts exam fees are administered by Prometric and remain consistent across all testing locations statewide. The cost of individual exams is $39 per exam, while taking two exams simultaneously costs $49 total.

Individual Exam Fees

- Property Insurance: $39

- Casualty Insurance: $39

- Life Insurance: $39

- Accident and Health Insurance: $39

Combined Exam Savings

Massachusetts offers significant savings when you take related exams together:

- Life and Accident/Health combination: $49 (saves $29)

- Property and Casualty combination: $49 (saves $29)

This combined approach not only saves money but also reduces the total time spent in testing centers. Most candidates pursuing life insurance licenses choose the combined option for maximum efficiency.

Payment Methods and Policies

Accepted Payment

- Credit cards (Visa, MasterCard, American Express, Discover)

- Debit cards

- Electronic checks

- Exam vouchers (if provided by your employer or training provider)

Important Payment Policies

Payment is due at the time of registration and exam registration fees are non-refundable and expire after 90 days if not used. Once you pay your exam fee, you cannot get it back even if you decide not to take the exam.

Retake Policies and Additional Costs

Unlimited Retakes

Massachusetts allows unlimited exam retakes with no waiting period between attempts. This policy is more generous than many states that impose waiting periods or limit the number of retake attempts.

Retake Fee Structure

Each retake requires payment of the full examination fee. There are no discounted retake rates, so first-time preparation becomes even more valuable. Quality exam preparation significantly increases your chances of passing on the first attempt.

Strategic Retake Considerations

If you don't pass on your first attempt, review your diagnostic score report to identify weak areas before scheduling a retake. Focus your additional study on specific topics where you scored poorly rather than reviewing all material equally.

Ready to take your insurance career to the next level?

If you’re eager to learn how to not only get licensed but also thrive in your insurance career, check out our Tips for Becoming a Successful Insurance Agent.

Single vs. Combined Testing Strategy

The decision between individual and combined exams affects both your costs and timeline:

Taking Individual Exams

- Total cost for two related lines: $78

- More flexibility in scheduling

- Ability to focus preparation on one line at a time

- Option to space exams apart

Taking Combined Exams

- Total cost for two related lines: $49

- Significant cost savings ($29)

- Single testing session

- Requires broader preparation scope

Most candidates choose the combined approach for the cost savings, but consider your learning style and available study time when deciding. Those pursuing property and casualty licensesProperty Casualty License Resources often benefit from the combined exam approach.

Special Circumstances and Exemptions

Fee Exemptions

Massachusetts offers licensing fee exemptions for military veterans who submit DD-214 documentation and individuals who submit appropriate documentation verifying legal blindness. These exemptions apply to the $225 license application fee, not the examination fees administered by Prometric.

Corporate Sponsorship

Some insurance companies or agencies pay examination fees for their prospective employees. If you're already in discussions with potential employers, ask about fee assistance or reimbursement programs.

Total Licensing Investment

Required Costs

- Exam fee: $39-49

- License application: $225

- NIPR processing: $5.60

- Lead paint surcharge (if applicable): $75

- Fingerprinting: varies by provider

Additional Considerations

- Quality exam preparation materials

- Practice exams and study guides

- Professional development resources

Understanding how to effectively prepare can help you avoid costly retakes and delays in starting your career.

Fee Payment Timeline

When Fees Are Due

- Exam fees: Due at time of scheduling

- Application fees: Due when submitting license application

- Background check fees: Due when completing fingerprinting

Strategic Payment Planning

Don't schedule your exam until you're confident in your preparation level. Since exam fees are non-refundable, premature scheduling can lead to unnecessary expenses if you're not ready to test.

Career Investment Perspective

Long-Term Value

While licensing fees represent an upfront investment, consider them against the earning potential of a Massachusetts insurance career. According to the Bureau of Labor StatisticsSales Insurance Sales Agents.htm Ooh, successful insurance agents typically recover their licensing investment quickly through their sales activity.

License Duration

Your Massachusetts insurance license is valid for three years before renewal, making the annual cost quite reasonable. Additionally, the skills and knowledge you gain during preparation benefit your entire career.

Managing Exam Costs Effectively

Cost-Saving Strategies

- Choose combined exams when pursuing multiple lines

- Invest in quality preparation to avoid retake fees

- Schedule strategically when you're ready to pass

- Research employer reimbursement programs

- Take advantage of exemptions if you qualify

Cost Impact of Retakes

Additional Attempt Fees

Each failed exam attempt requires paying the full examination fee again:

- Each retake costs the same as the original exam

- Multiple attempts can add up quickly

- Lost time delays your career start

Minimizing Retake Risk

The most effective way to control your licensing costs is to pass on your first attempt. This requires adequate preparation time and quality study materials focused on both national insurance concepts and Massachusetts-specific regulations.

Remote vs. In-Person Testing Costs

Identical Fees

Whether you choose remote proctoring or in-person testing at a Prometric center, the examination fees remain the same. Your choice should be based on your comfort level and technical setup rather than cost considerations.

Additional Considerations

Remote testing may save transportation costs and time off work, while in-person testing eliminates technical setup concerns that could affect your performance.

Renewal Planning

Ongoing Requirements

While not immediate, plan for ongoing license maintenance:

- License renewal fee every three years

- Lead paint surcharge (if applicable) for renewal

- Continuing education courses

- Possible additional training requirements for specific products

Understanding these ongoing requirements helps you make informed decisions about your long-term career commitment. Those interested in maintaining their credentials should explore continuing education options early.

Continuing Education Requirements

Massachusetts requires 60 hours of continuing education during your first three-year license term, then 45 hours every subsequent three years, including 3 hours of ethics training. This ensures you stay current with industry changes and regulations.

Making Your Investment Count

Maximize Your Success

Since you're investing in your future career, make every dollar count:

- Choose comprehensive preparation over free alternatives

- Understand that quality education reduces total licensing costs

- Consider building professional networks early

Start Your Massachusetts Insurance Career

Don't let exam fees become a barrier to your new career. Understanding the complete fee structure helps you budget effectively and make informed decisions about your licensing journey.

Aceable Insurance offers comprehensive Massachusetts exam preparation designed to help you pass on your first attempt, minimizing your total licensing investment. Our proven curriculum covers both national insurance concepts and Massachusetts-specific regulations with unlimited practice exams and expert support.

Invest in your success - start your Massachusetts insurance career preparation today and join thousands of successful agents who chose Aceable Insurance for their licensing journey. Quality preparation is the best investment you can make in your insurance career.

Ready to get started?

Your future in the insurance industry starts now.