Life After You Get Your Missouri Insurance License

Ready to level up your insurance game? Get the expert guidance and resources you need to go pro.

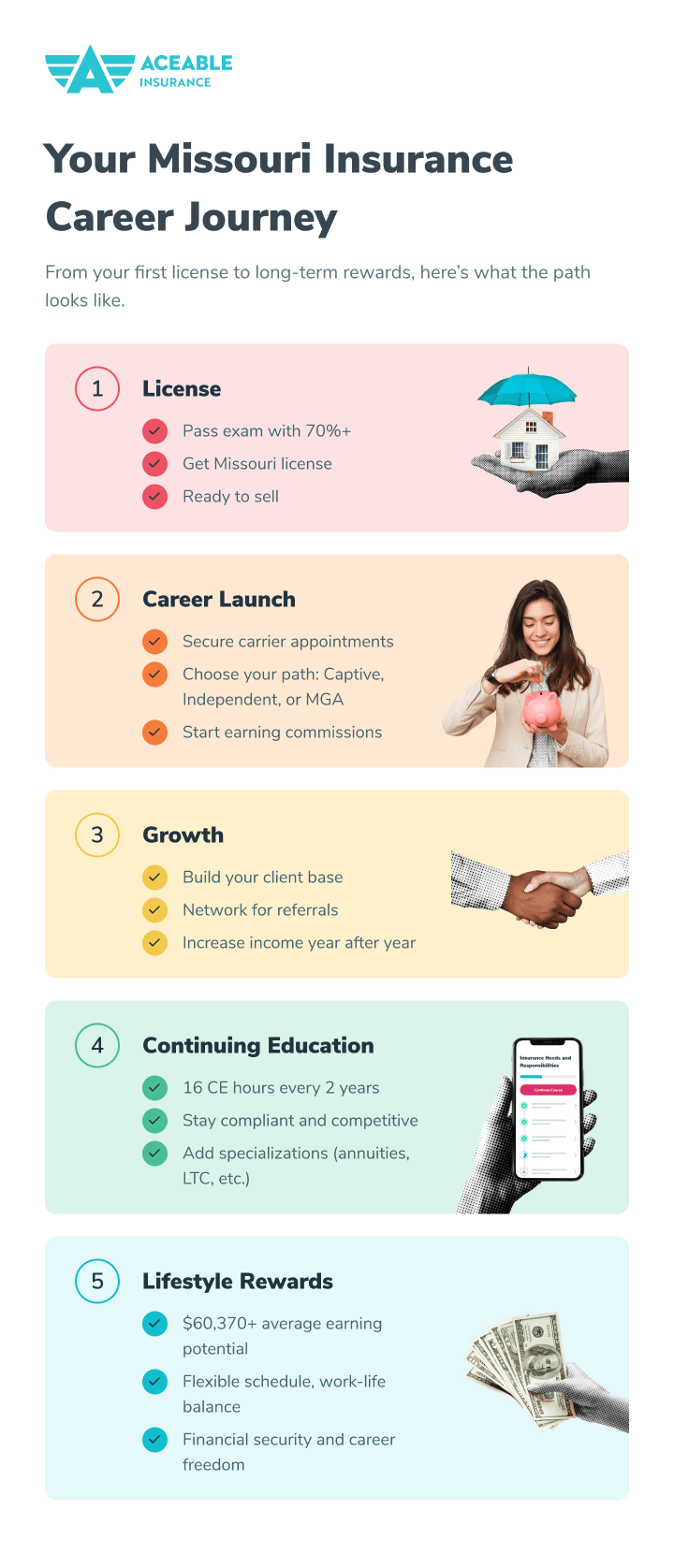

Quick Answer:

- Get appointed with insurance carriers to start selling their products and earning commissions

- Complete 16 hours of continuing education every two years (3 hours must be ethics)

- Choose between captive, independent, or specialized career paths based on your goals

Step 1: Secure Insurance Company Appointments

Your Missouri insurance license allows you to legally sell insurance, but you can't start earning commissions until you're appointed with insurance carriers. An appointment is essentially a contract between you and an insurance company that authorizes you to sell their products.

Types of Appointment Arrangements:

Captive Agent

- Represent one primary insurance company

- Receive extensive training and support

- Company provides leads and marketing materials

- Steady income potential with salary plus commission

- Limited to one company's product portfolio

Independent Agent

- Work with multiple insurance carriers

- Greater product variety to serve clients

- Higher earning potential but more responsibility

- Must generate your own leads and marketing

- Requires stronger business development skills

Managing General Agent (MGA)

- Specialized role focusing on specific markets

- Higher commission rates and override potential

- Recruit and train other agents

- Requires significant experience and capital

When choosing your path, consider how to start a career in property & casualty insuranceResources Pre License Is Becoming A Licensed Property And Casualty Insurance Agent Worth It Insurance.aceable.com or other specializations based on your license type and interests.

Step 2: Build Your Client Base and Sales Skills

Success in insurance depends on your ability to build relationships and help clients make informed decisions about their coverage needs. Missouri's diverse economy provides opportunities to serve various client segments.

Effective Client Acquisition Strategies:

- Networking: Join local business organizations and community groups

- Referrals: Provide exceptional service to generate word-of-mouth business

- Digital Marketing: Develop online presence through social media and websites

- Cold Calling: Traditional but effective for certain markets

- Cross-Selling: Expand relationships with existing clients

Key Markets in Missouri:

- Kansas City Metro: Growing tech sector and established businesses

- St. Louis Area: Healthcare, aerospace, and financial services

- Rural Communities: Agricultural and small business insurance needs

- College Towns: Student housing and young professional markets

Step 3: Master Missouri's Continuing Education Requirements

Missouri requires ongoing education to maintain your license and stay current with industry changes. Understanding these requirements helps you plan your professional development strategically.

Missouri CE Requirements:

- Major Lines Producers: 16 hours every two years

- Title Producers: 8 hours every two years

- 3 hours must be in ethics (for major lines)

- Renewal deadline: Last day of your birthday month

- Excess credits: Up to 12 hours can carry forward

Special Training Requirements:

Long-Term Care Insurance:

- Initial 8-hour course before selling LTC products

- 4-hour refresher course each renewal period

Flood Insurance:

- One-time 3-hour NFIP course for Property/Casualty agents

- Required before selling flood insurance policies

Annuity Products:

- One-time 4-hour Annuity Suitability course

- Required before selling any annuity products

The Missouri Department of Commerce and InsuranceInsurance.mo.gov maintains current CE requirements, and staying compliant protects your ability to earn income continuously.

Step 4: Develop Specialized Expertise

As you gain experience, developing expertise in specific insurance areas can significantly increase your earning potential and client value. Missouri's diverse economy offers numerous specialization opportunities.

High-Demand Specializations:

Commercial Lines

- Business liability and property coverage

- Workers' compensation

- Professional liability for Missouri businesses

Life and Financial Services

- Estate planning for high-net-worth individuals

- Business succession planning

- Employee benefits for growing companies

Personal Lines Excellence

- High-value home insurance

- Classic car and recreational vehicle coverage

- Umbrella policies for asset protection

Emerging Markets

- Cyber liability insurance for businesses

- Cannabis business insurance (as regulations evolve)

- Remote work liability coverage

Consider your natural interests and local market needs when choosing specializations. Becoming an insurance agent with no experienceResources Pre License How To Become An Insurance Agent With No Experience Insurance.aceable.com doesn't limit your potential—many successful specialists started with general knowledge and developed expertise over time.

Step 5: Plan Your Long-Term Career Growth

Insurance offers multiple career advancement paths beyond traditional sales roles. Planning your trajectory early helps you make strategic decisions about education, networking, and skill development.

Career Advancement Opportunities:

Management Roles

- Agency manager or branch manager

- Regional sales manager

- State manager positions

Business Ownership

- Open your own independent agency

- Purchase existing agency through acquisition

- Develop niche market expertise

Insurance Company Careers

- Underwriter or claims adjuster

- Product development specialist

- Corporate training and development

Related Professional Services

- Risk management consultant

- Employee benefits specialist

- Insurance-focused attorney or accountant

Professional Development Investments:

- Industry designations (CPCU, CIC, CLU, ChFC)

- Advanced continuing education beyond minimums

- Professional association memberships

- Industry conference attendance

- Mentorship relationships with successful agents

Ready to take your insurance career to the next level?

If you’re eager to learn how to not only get licensed but also thrive in your insurance career, check out our Tips for Becoming a Successful Insurance Agent.

Understanding Missouri's Insurance Market Opportunities

Missouri's central location and diverse economy create excellent opportunities for insurance professionals. Understanding local market dynamics helps you position yourself for success.

Economic Drivers Creating Insurance Opportunities:

- Agriculture: Crop insurance and farm liability coverage

- Manufacturing: Commercial property and liability needs

- Healthcare: Professional liability and employee benefits

- Transportation: Commercial auto and cargo coverage

- Technology: Cyber liability and errors & omissions

Geographic Considerations:

- Urban Markets: Higher volume, more competition, diverse client needs

- Rural Areas: Lower competition, relationship-based business, agricultural expertise valuable

- Suburban Growth Areas: New construction, growing families, expanding businesses

Avoiding Common New Agent Mistakes

Learning from others' experiences accelerates your success and helps avoid costly mistakes that derail promising careers.

Common Pitfalls to Avoid:

- Inadequate prospecting: Not maintaining consistent lead generation activities

- Poor time management: Failing to prioritize high-value activities

- Insufficient product knowledge: Not understanding policy details and exclusions

- Compliance issues: Neglecting CE requirements or appointment renewals

- Pricing focus: Competing solely on price rather than value and service

Success Strategies:

- Consistent daily activities: Maintain regular prospecting and client contact schedules

- Continuous learning: Stay current with products, regulations, and industry trends

- Client-focused approach: Prioritize client needs over commission opportunities

- Professional development: Invest in skills, designations, and industry relationships

- Technology adoption: Use CRM systems and digital tools effectively

Building Your Professional Network

Success in insurance often depends more on relationships than product knowledge. Building a strong professional network opens doors to referrals, partnerships, and career opportunities.

Key Networking Opportunities:

- Local insurance associations: Missouri Association of Insurance Agents

- Industry conferences: State and national insurance events

- Business organizations: Chamber of Commerce, Rotary, industry-specific groups

- Professional designations: Study groups and designation societies

- Online communities: LinkedIn groups and industry forums

Relationship Building Tips:

- Give before you get: Provide value to others before asking for referrals

- Stay in regular contact: Consistent communication maintains relationships

- Be genuinely interested: Focus on others' success and challenges

- Follow through: Always do what you say you'll do

- Express gratitude: Acknowledge help and referrals promptly

Your Missouri Insurance Career Starts Now

Getting your Missouri insurance license was just the first step in what can be a rewarding, lucrative career helping others protect what matters most. The insurance industry offers stability, growth potential, and the satisfaction of making a real difference in people's lives during their most challenging moments.

Success in insurance isn't guaranteed—it requires dedication, continuous learning, and genuine care for clients. But for those willing to put in the effort, Missouri's diverse economy and growing population provide excellent opportunitie

Ready to get started?

Your future in the Missouri insurance industry starts now.