Can Real Estate Agents Sell Insurance in Missouri? Complete Dual Licensing Guide

Ready to level up your insurance game? Get the expert guidance and resources you need to go pro.

Quick Answer

- Missouri generally permits dual licensing - Real estate agents can typically obtain insurance licenses with proper compliance

- No pre-licensing education required - Missouri streamlines the path to insurance licensing

- Insurance industry growth - 4% employment growth projected from 2024 to 2034 creates opportunities for professionals in related fields

Missouri's Regulatory Framework for Dual Services

Missouri's regulatory environment generally permits professionals to hold multiple licenses when they meet the requirements for each profession separately. However, this comes with compliance obligations that protect consumers and maintain professional integrity.

The Missouri Department of Commerce and InsuranceLicensing Dci.mo.gov oversees insurance licensing, while real estate licensing falls under a separate division, requiring professionals to understand requirements for both fields.

Required Disclosure and Service Separation

Missouri law establishes clear requirements for professionals who provide both real estate and insurance services. As a dual-licensed professional, you must:

Disclosure Requirements:

- Disclose your dual licensing status

- Maintain transparency about potential conflicts of interest

- Provide clear communication about which service you're providing

Service Separation Requirements: Missouri requires that services remain separate and optional. As a dual-licensed professional, you should:

- Never make insurance purchases a condition of real estate transactions

- Avoid bundling insurance costs into real estate contracts

- Not require clients to buy insurance through you to complete real estate deals

You may:

- Offer insurance as a separate, optional service

- Provide competitive quotes when clients express interest

- Explain coverage options during the buying process

- Assist with insurance needs as a separate service line

Recent Changes Make Licensing Easier

Missouri has maintained its streamlined approach to insurance licensing with no pre-licensing education requirements, according to the Missouri Department of Commerce and InsuranceIndustry Faq License.php Insurance.mo.gov. This approach removes a significant barrier for busy real estate professionals.

However, successful candidates still invest in quality preparation. Missouri continues to administer comprehensive exams covering both national insurance concepts and Missouri-specific regulations.

Why Preparation Matters Despite No Education Requirement

Insurance operates differently from real estate, with distinct terminology, concepts, and regulatory frameworks. Quality exam prepPre License How To Study Insurance Licensing Exam Resources through structured courses helps ensure first-attempt success.

Research consistently shows that candidates using structured preparation have significantly higher pass rates compared to those studying independently. This investment pays dividends through:

- Higher first-attempt pass rates

- Confidence in client conversations

- Ongoing reference materials for practice

- Solid foundation for building insurance skillsPre License How To Get An Insurance License In Missouri Resources

Ready to take your insurance career to the next level?

If you’re eager to learn how to not only get licensed but also thrive in your insurance career, check out our Tips for Becoming a Successful Insurance Agent.

The Business Case for Dual Licensing

Real estate agents possess unique advantages in insurance sales that traditional insurance-only agents lack. You already have established trust relationships with clients who've entrusted you with their largest financial transactions. You understand property characteristics, neighborhood risk factors, and local market conditions.

The timing alignment creates natural opportunities. When clients need insurance for closing, you're already discussing their protection needs. Annual policy renewals create ongoing touchpoints that generate real estate referrals when clients experience life changes.

Most importantly, insurance provides recurring annual revenue that continues regardless of real estate market conditions. This income diversification helps smooth seasonal fluctuations and market cycles that affect transaction-based earnings.

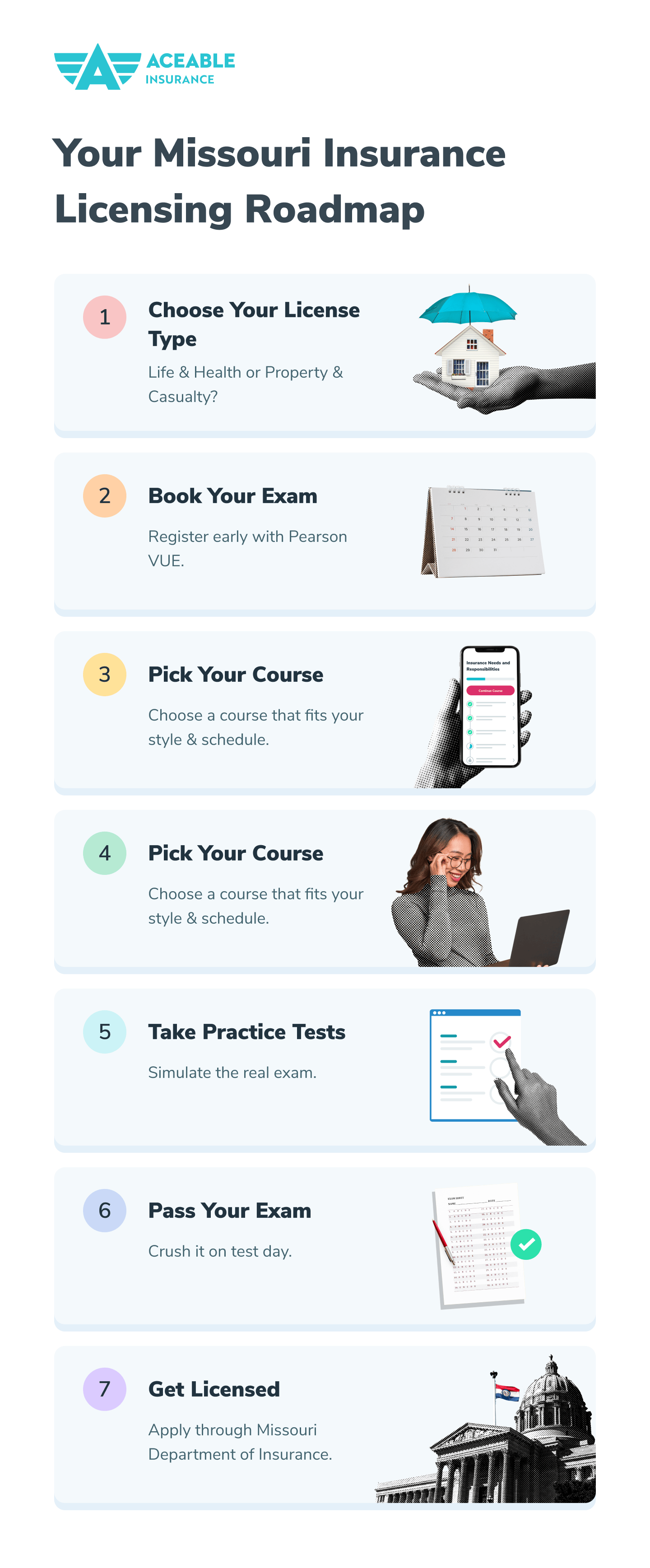

Getting Started with Insurance Licensing

The licensing process involves three main steps: exam preparation, passing the state exam, and partnering with an agency for carrier appointments. Each step builds toward your ability to serve clients and generate recurring revenue.

Step 1: Exam Preparation

While Missouri doesn't require pre-licensing courses, quality preparation remains essential. Look for programs that offer:

- Missouri-specific content and regulations

- Practice exams that simulate actual testing conditions

- Flexible study options that accommodate real estate schedules

- Expert instructor support for complex concepts

Step 2: State Examination

Missouri administers insurance exams through Pearson VUEMO Insurance Home.pearsonvue.com. The exam covers both general insurance principles and Missouri-specific laws and regulations. Understanding study tips helps ensure success.

Step 3: Agency Partnership

Before writing policies, you need carrier appointments and professional liability insurance. Agency partnerships provide these essentials while handling administrative complexities, allowing you to focus on client relationships and business building.

Professional Support and Continuing Education

The Missouri Department of Commerce and InsuranceLicensing Dci.mo.govLicensing Dci.mo.gov provides ongoing guidance for dual-licensed professionals, including continuing education requirements, ethical guidelines, and best practices for serving clients professionally.

Licensed agents must complete 16 hours of continuing education every two yearsContinuing Education Insurance.mo.gov, including 3 hours of ethics training. These requirements ensure you stay current with industry changes, new products, and regulatory updates that affect your practice.

Ready to take your insurance career to the next level? If you're eager to learn how to not only get licensed but also thrive in your insurance career, check out our success tipsPre License Tips Becoming A Successful Insurance Agent Resources.

Making the Strategic Decision

Dual licensing represents a significant business opportunity for Missouri real estate agents willing to invest in proper preparation and professional development. The regulatory environment supports this expansion, market demand continues growing, and the business model provides both immediate revenue and long-term relationship benefits.

Success requires commitment to learning insurance concepts, maintaining ethical standards, and providing excellent service in both professional areas. For agents ready to expand their expertise and income potential, Missouri's dual licensing framework provides clear pathways to success.

Ready to Explore Insurance Licensing?

Before making any decisions about dual licensing, consult with both the Missouri Department of Commerce and InsuranceLicensing Dci.mo.govLicensing Dci.mo.gov (573-751-3518) and Missouri Real Estate Commission to ensure you understand all current requirements and compliance obligations.

Aceable Insurance offers Missouri-focused preparation designed for professionals seeking to expand their services while maintaining full regulatory compliance. Our streamlined approach helps busy real estate professionals get licensed quickly and confidently.

Why choose Aceable Insurance:

- Proven success rates: Our students consistently pass Missouri exams

- Missouri-specific preparation: Content focused on state laws and regulations

- Flexible online learning: Study on your schedule, anywhere

- Expert support: Get help when you need it most

- Realistic practice exams: Build confidence with exam simulations

Transform your real estate practice with the stability and recurring revenue that insurance licensing provides. Your clients need comprehensive property expertise, and Missouri's favorable regulations make dual licensing accessible.

Start your Missouri insurance licensing journey with Aceable Insurance today.

Important Legal Disclaimer: This information is for educational purposes only and should not be construed as legal advice. Licensing requirements, regulations, and professional obligations can change. Before pursuing dual licensing, consult with the Missouri Department of Commerce and Insurance (573-751-3518) and Missouri Real Estate Commission to verify current requirements and ensure full compliance with all applicable laws and regulations. Individual circumstances may affect licensing eligibility.

Ready to take the first step?

Your future in the Missouri insurance industry starts now.